How does the National Insurance change of January 2024 impact my pension?

15th January 2024

In January 2024, the National Insurance rates will have an adjustment and a noteworthy change to your take home pay. The employee National Insurance contribution level is decreasing from 12% to 10% for individuals earning less than £50,270. So, what does this mean?

You will automatically save 2% on your earnings after your tax-free allowance (£12,570 – 2023/2024) which will be shown to you by an uplift in your take home pay.

How does this affect my pension contributions?

Let’s use some round figures here to illustrate. If you earned £30,000 per annum and contributed 5%, then you would be putting £125 per month into your pension as an employee with the standard tax relief.

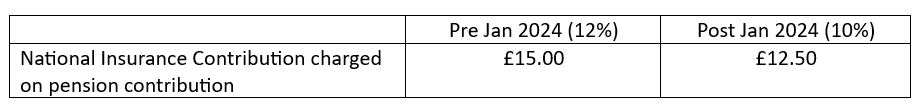

Now, we are assuming a couple of things here such as your contribution method being via net pay. Before January you would have been paying £15 per month in National Insurance (12%) on that contribution. Going forwards your pension contribution will have 10% National Insurance applied, so your contribution will carry £12.50 – a saving of £2.50 a month.

Here is an example written out: –

There is a saving on the pension contribution of £2.50.

Is there anything I can do to save more on my pension contribution?

That’s a great question and there is. It’s called Salary Exchange (also known as Salary Sacrifice) and is an alternative method to contributing towards a pension scheme.

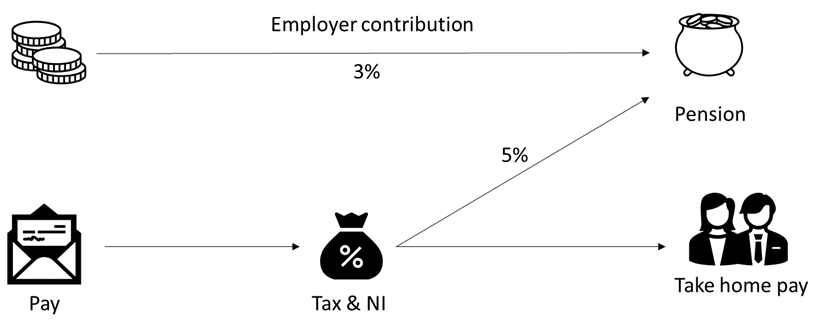

Here’s how it works. In the traditional approach to pension contributions, the amount an employee contributes to their pension is deducted from their earnings. This deducted amount is subject to income tax and National Insurance contributions for both the employer and the employee.

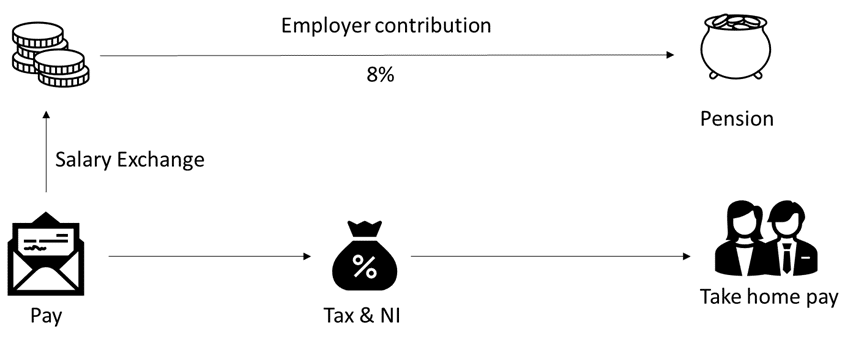

When an employee opts for Salary Exchange as their contribution method, they forego a portion of their salary. In return, the employer matches this amount in the form of an increased employer contribution. The employee doesn’t receive the sacrificed salary, thus neither income tax nor National Insurance contributions are applicable to it, for both the employee and the employer.

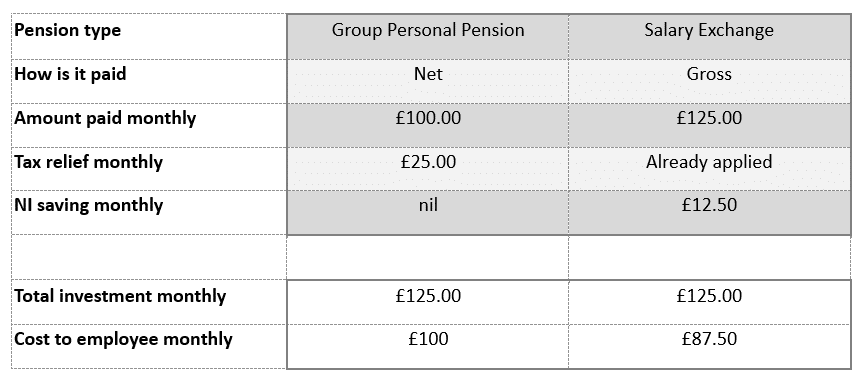

Here’s an illustration using our earlier figures based on earnings of £30,000: –

Whether pension contributions are made net (via Group Personal Pension) or gross (via Trust-based schemes), they are already exempt from income tax. However, opting for Salary Sacrifice offers an additional advantage by reducing National Insurance contributions on the amount of the pension contribution.

Another benefit of this method is individuals in higher or additional tax brackets no longer need to individually claim extra tax relief, as it is automatically incorporated.

Enhancing pension contributions or strengthening take-home pay could amount to a massive help during the cost-of-living crisis.