Underinsurance – what’s the real cost to you?

10th February 2023

What is Underinsurance?

Underinsurance occurs when you don’t have enough insurance cover to meet your needs. If the declared values of property and assets are not correct, or when the time it would take to get your business back up and running after a loss is underestimated, you could be underinsured.

The effect on your business of being underinsured

Due to the rapid inflation in the cost of building materials, approximately 40% of businesses are finding themselves underinsured when they have an insurance claim, meaning they are having to find the additional money themselves to rebuild the property, for example, which can have a serious impact on your business.

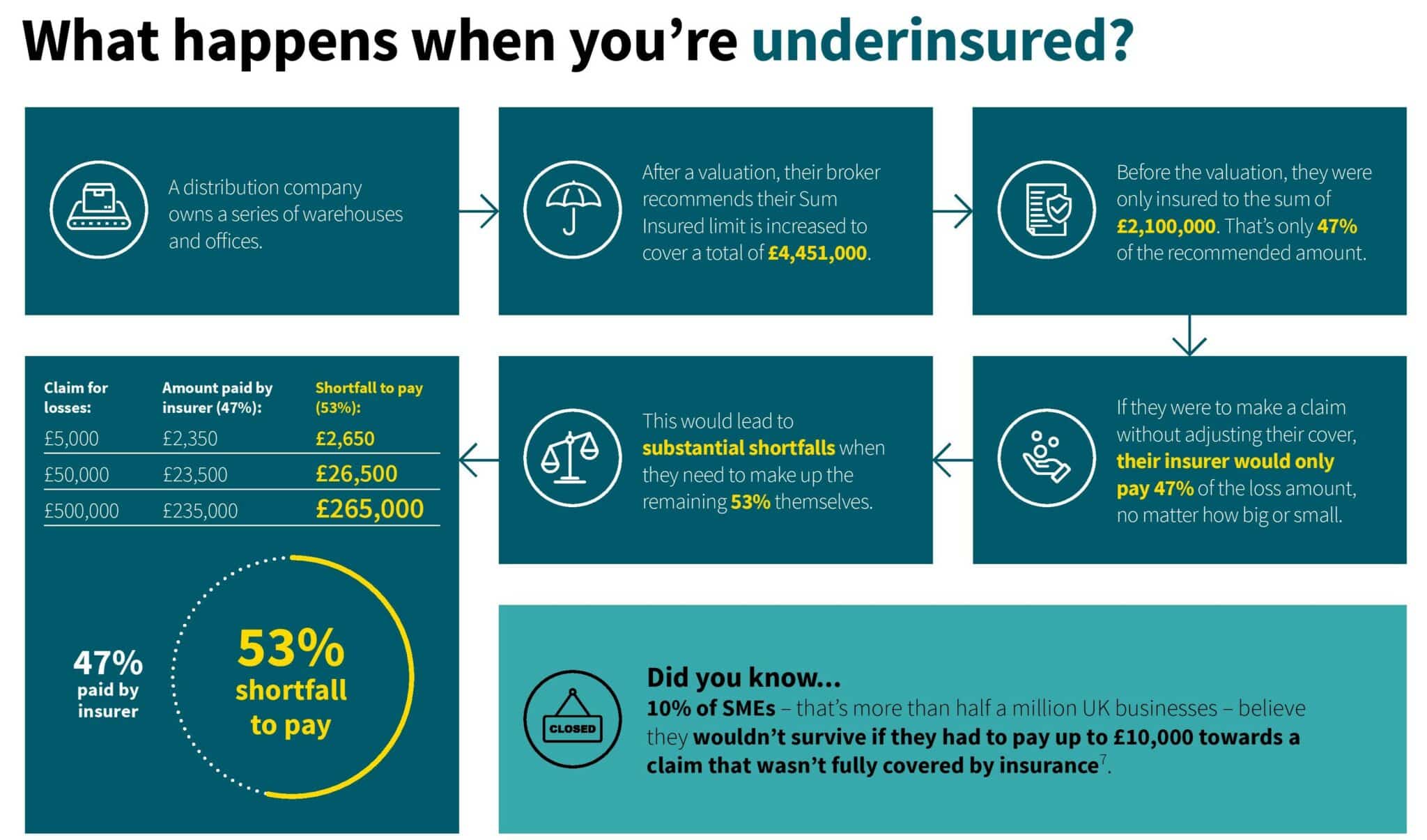

The consequences of underinsurance can leave you unable to claim for your full loss and can also mean that the ‘average’ rule is applied, which then reduces your claim even further. An example of this is set out below:

(taken from Aviva Underinsurance Guide – December 2022)

How to avoid being underinsured

The most important factor in order to avoid being underinsured is a professional valuation for insurance purposes, which calculates the cost of rebuilding a premises from the ground up should it be destroyed (e.g., by a fire). This is different from a market valuation which represents the likely amount a building would sell for on the market at the time the valuation is made.

Index linking for residential and commercial buildings is also relevant after receiving a professional rebuild valuation. This is applied by insurers to ensure that an asset’s insured value is adjusted in line with changes in inflation, deflation, and the cost of living. It’s commonly used in buildings insurance to calculate the difference between the sum insured and a property’s rebuild value. However, index linking is not limited to buildings. Changes and developments in the macroeconomic environment can affect the value of other assets, such as stock, materials, and parts. Professional rebuild valuation, index linking and regular and disciplined sums insured reviews are necessary.

How COHIBL can help you

We are very fortunate to have our very own Risk Manager that can help assist our clients with a complimentary Desktop Valuation, which would otherwise be chargeable when seeking a professional rebuild valuation from a valuer.

We can regularly review your sums insured each year, and at mid-term where needed.

We can have conversations about looking to alter the basis of cover to make it more cost-effective.

We can also have discussions where necessary, around the consideration of taking out a longer indemnity period for your Business Interruption policy, taking into account all external economic factors and current influences on inflation which could delay the repair, reinstatement or rebuild of their property.