With over 300 insurance companies in the UK alone, each offering insurance policies with varying levels of cover or benefit and not one policy being the same, navigating the insurance industry can be complex and time consuming.

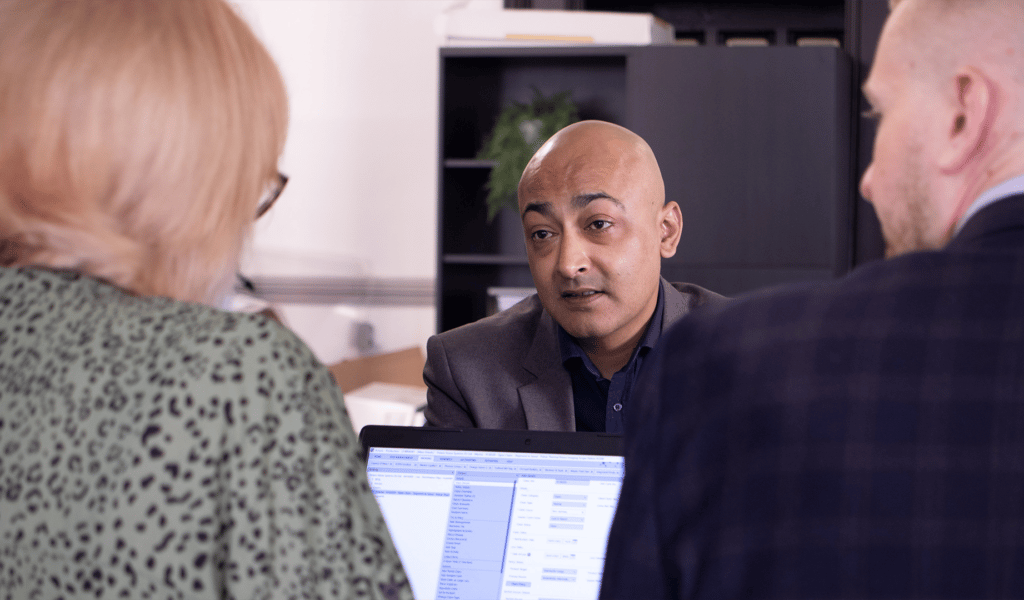

Caunce O’Hara Insurance Brokers approach of taking the time to know our customers and what matters most to them, coupled with our approach to risk management, helps us find the right cover, with the right insurance partner, at the right price.

Talk to Our Team

We offer an unrivalled expertise in product knowledge, and have industry specialists in

Buildings, Machinery & Contents

Business Interruption

Commercial Property Owners

Commercial Crime/Theft Cover

Cyber, Ransom & Data Risks Insurance

Professional Indemnity Insurance

Directors and Officers Liability Insurance

Employer’s Liability Insurance

Public Liability Insurance

Legal Expenses Insurance

Marine Cargo Insurance

Motor Fleet Insurance

Motor Trade Insurance

Property Owners Insurance

How We Care

Read moreContact Us

Talk to Our Team